Streamline Customer

Verification

Authentication

Onboarding

Process

or APIs to verify users and vendors in real time.

- No-code platform

- 5 second on-boarding

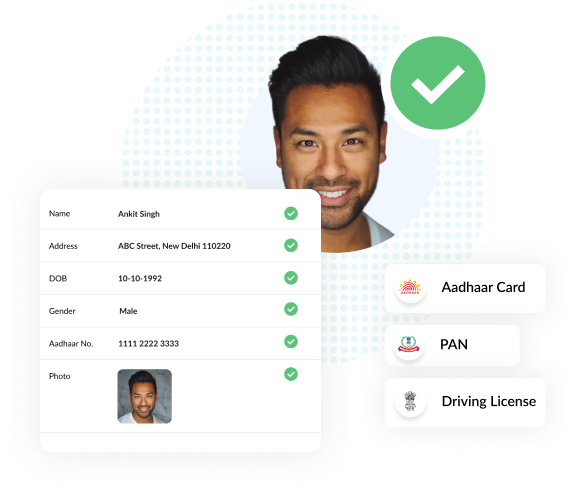

Complete KYC Solution

Streamline onboarding with robust identity verification processes, ensuring security and compliance

- Identity

- Banking

- Education

- Age Check

- EPFO API

- Company Check

SINGLE & BULK user VERIFICATION

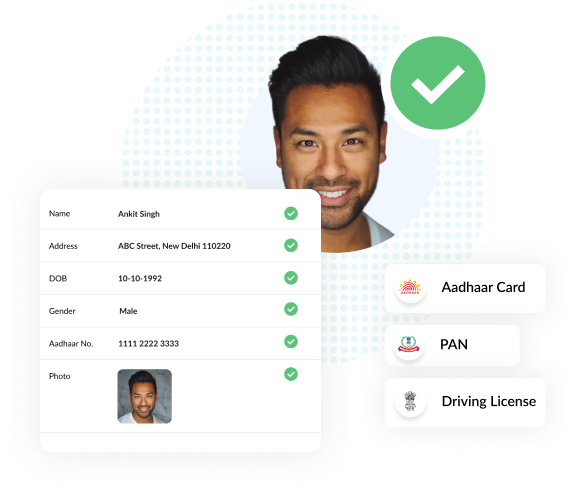

Identity Verification made simple

- Aaadhar

- PAN

- Driving License

- Voter ID

- Passport

- Liveness Check

- Facematch Check

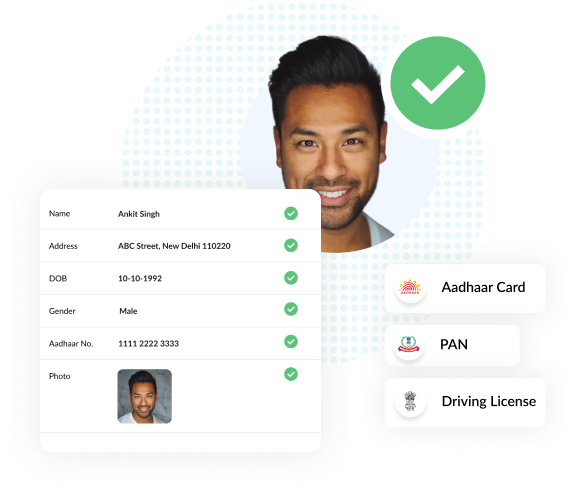

Aadhar Verification

Authenticate user’s Aadhar details. Get information such as the registered name, gender, birthdate, address, state, user’s photograph, father’s name, contact number, and email address in seconds.

- Obtain user approval by activating OTP-based Authentication

- Verify address

- Match name as per UIDAI records

- Use an API to automatically populate the relevant fields, enhancing the speed and accuracy of form completion.

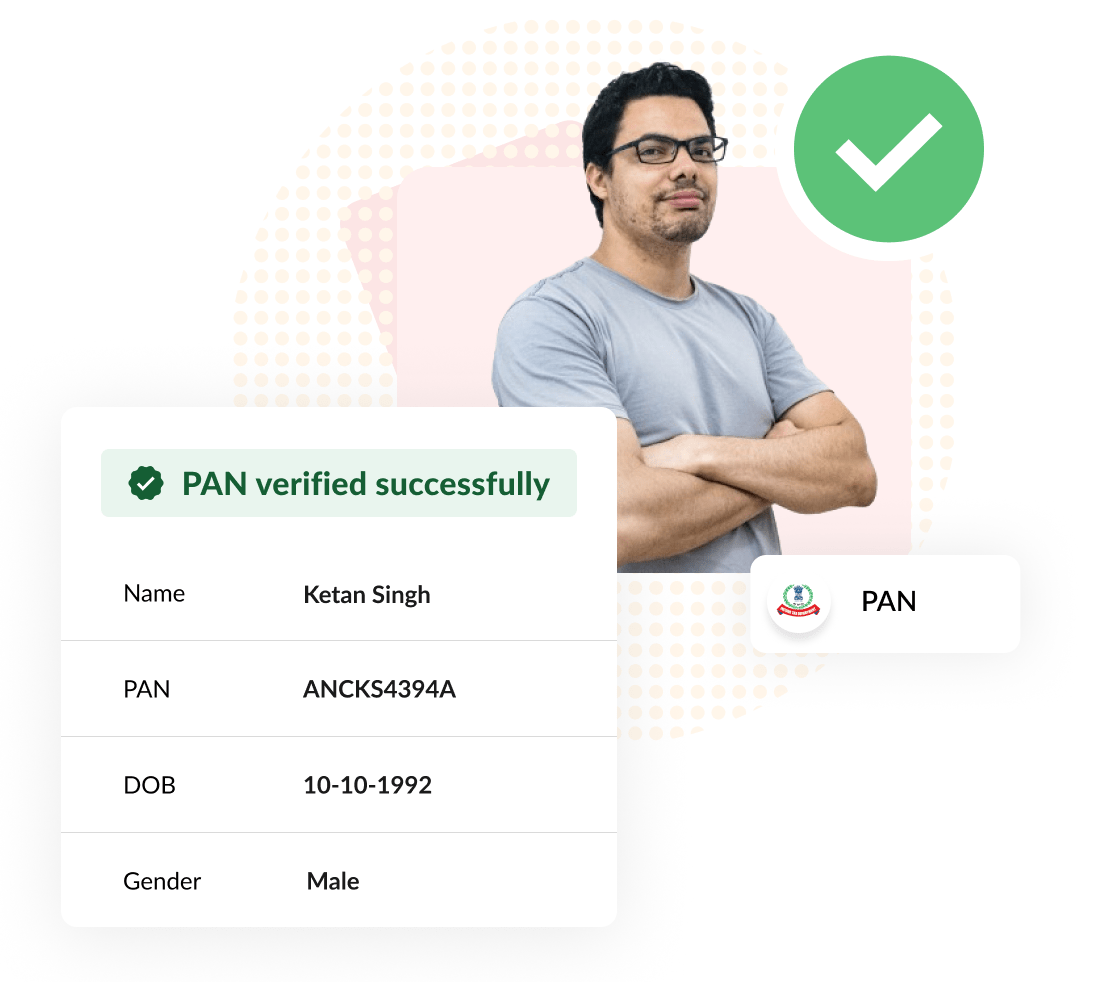

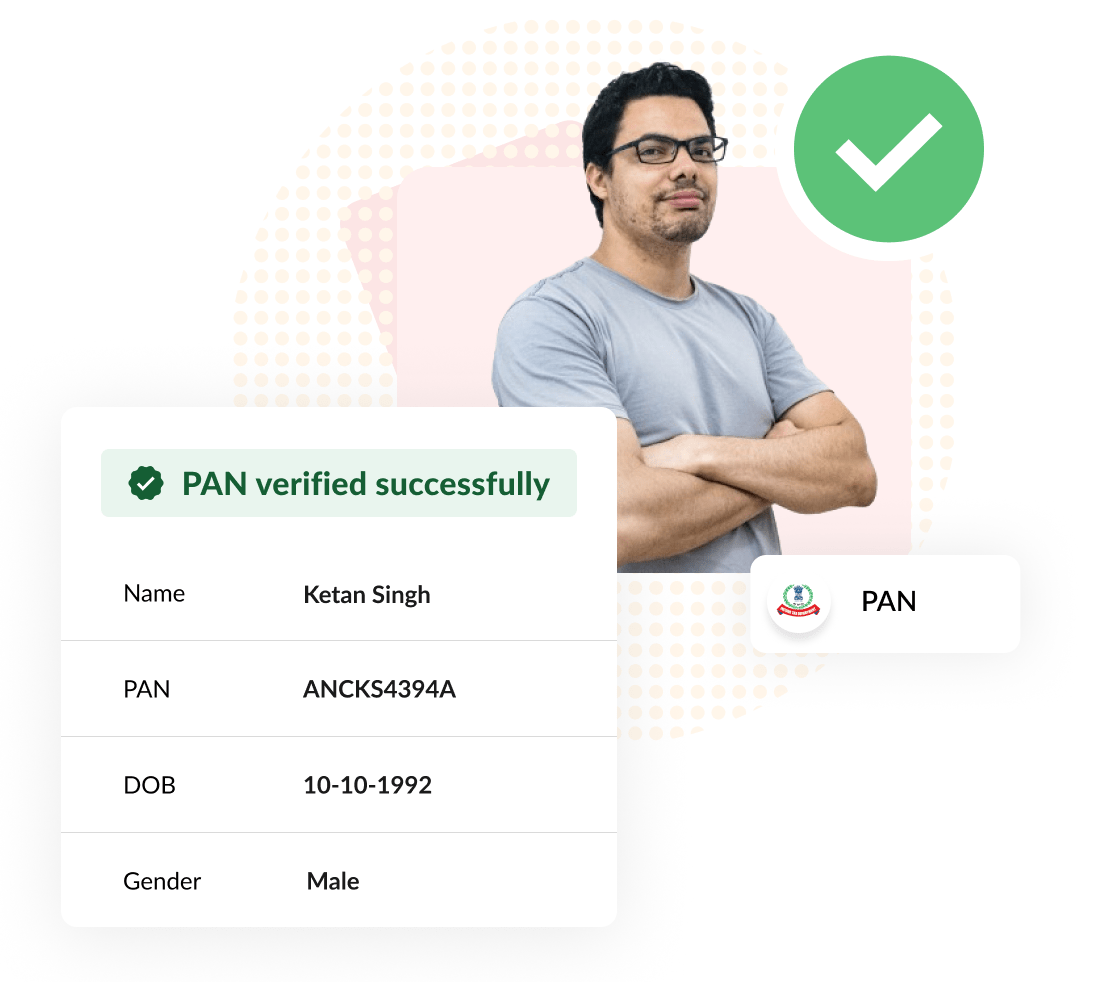

Pan Verification

- Validate the PAN category

- Cross-reference the name with the NSDL database

- Check if Aadhaar is linked with PAN

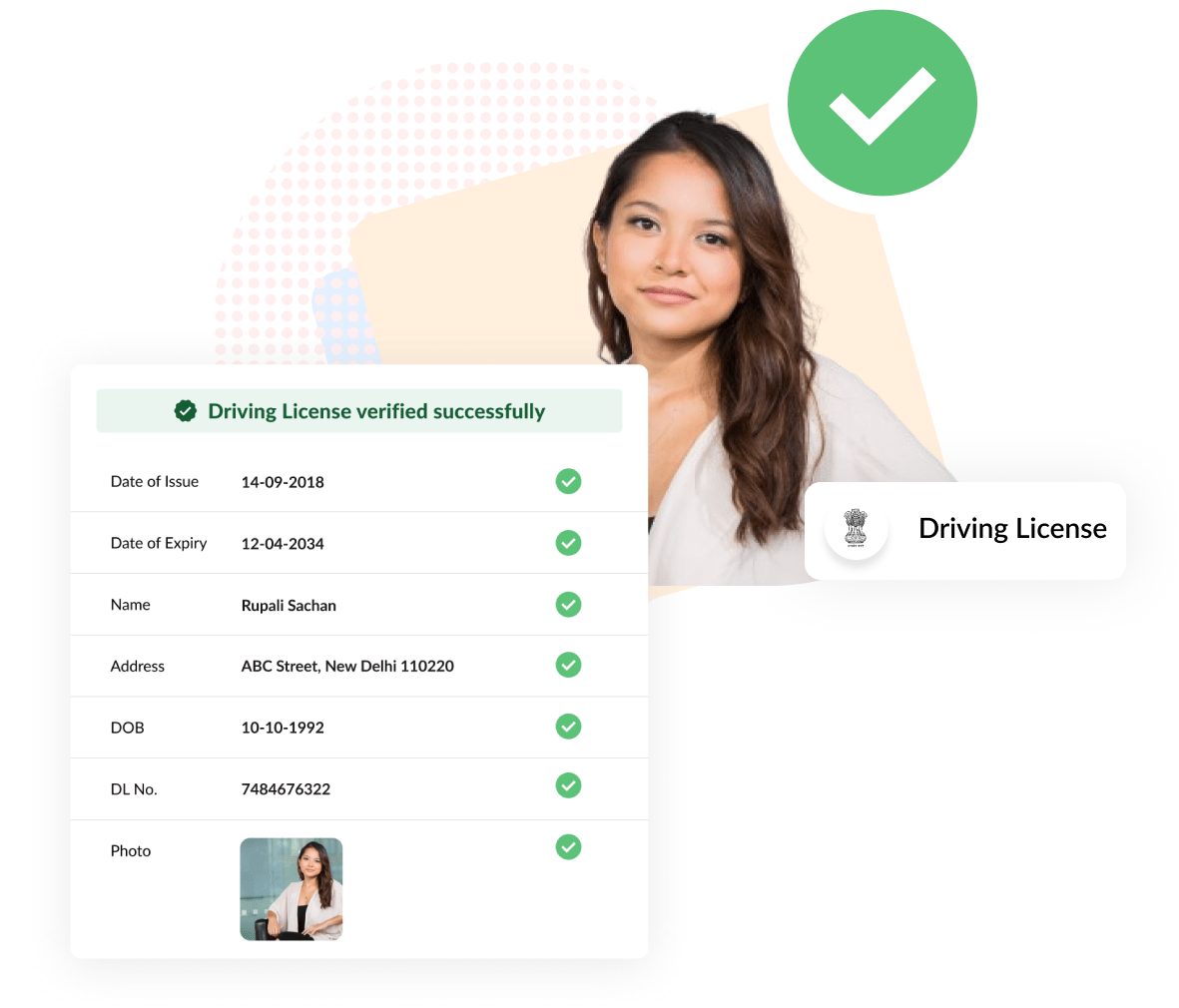

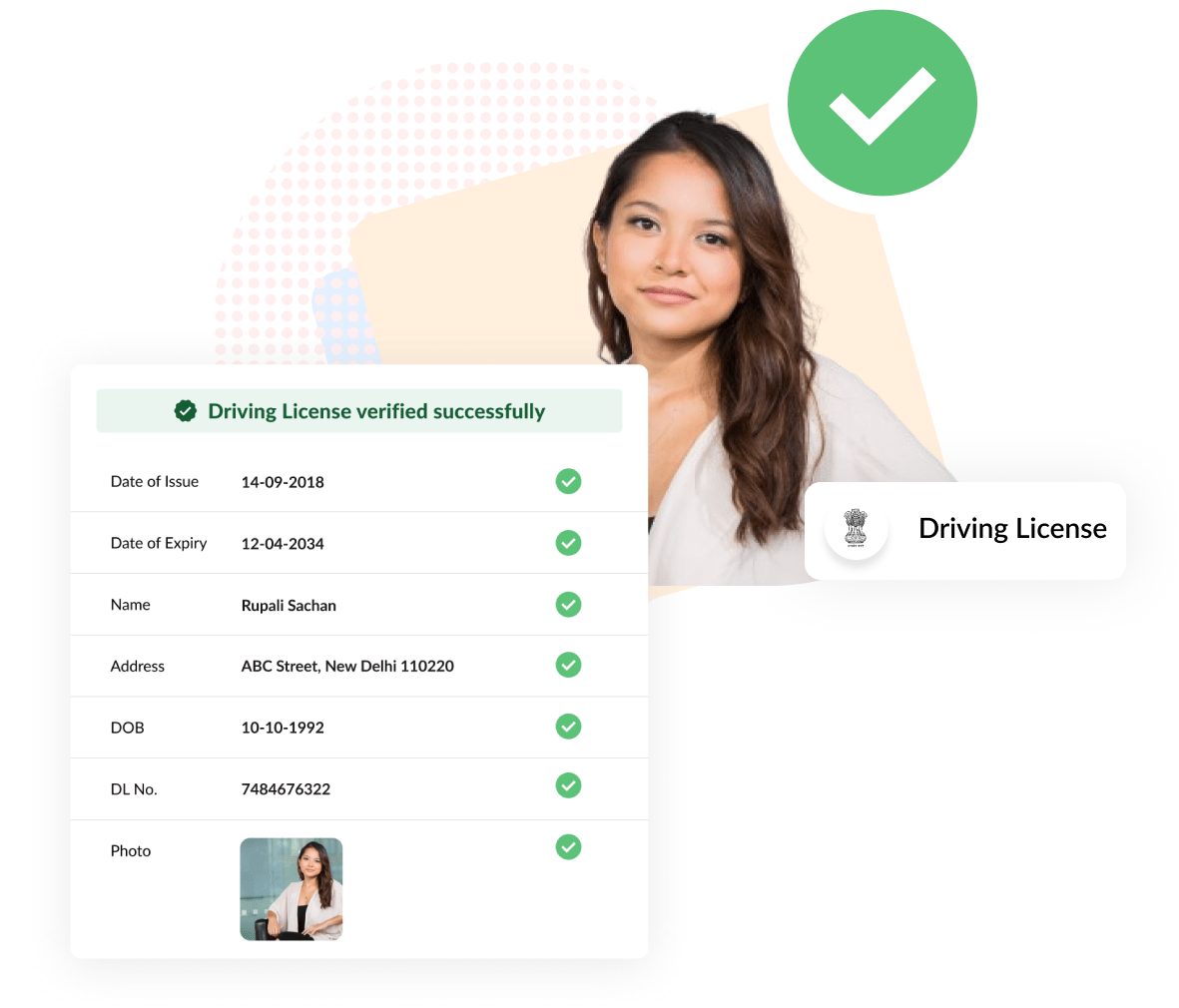

Driving License

- Name

- Address

- Birthdate

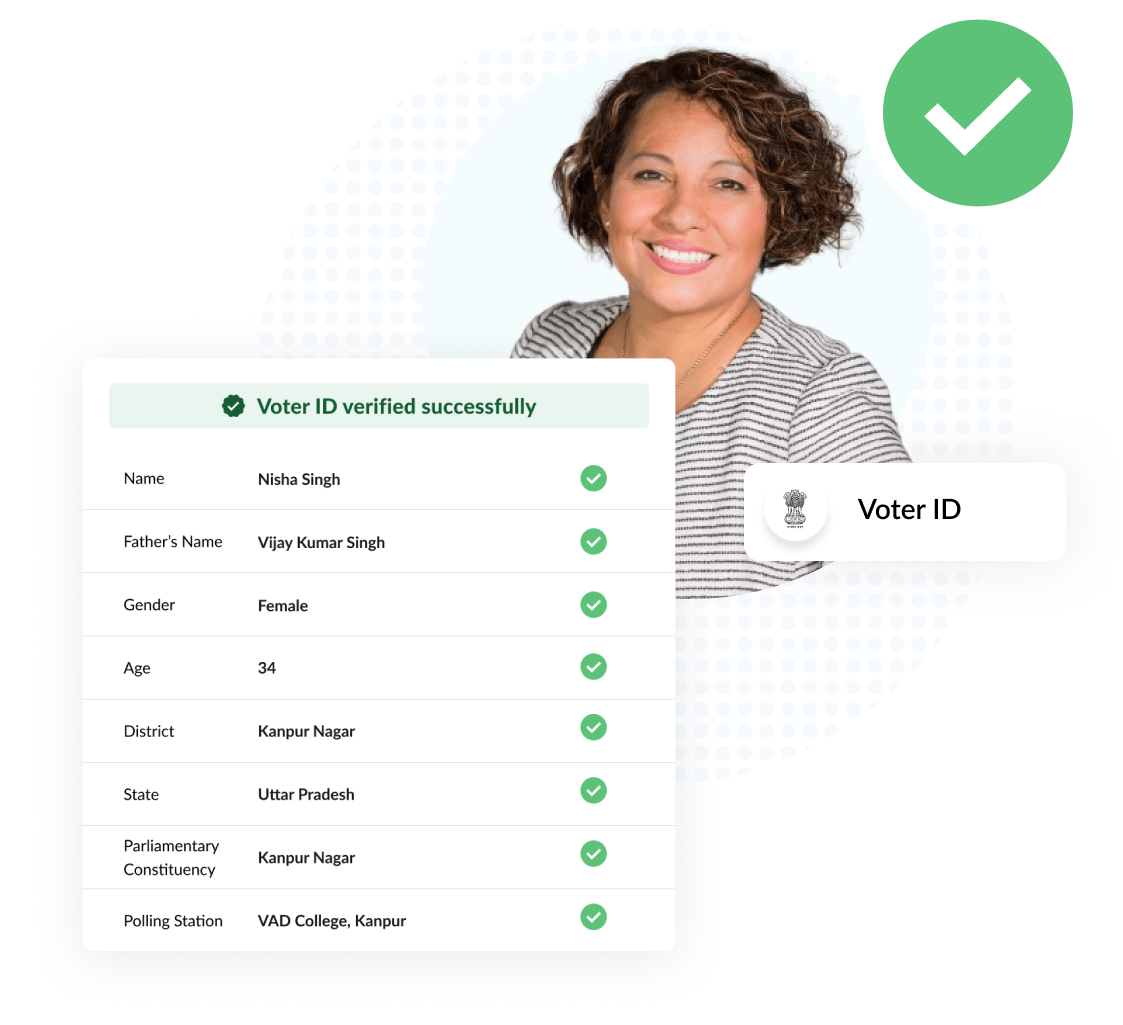

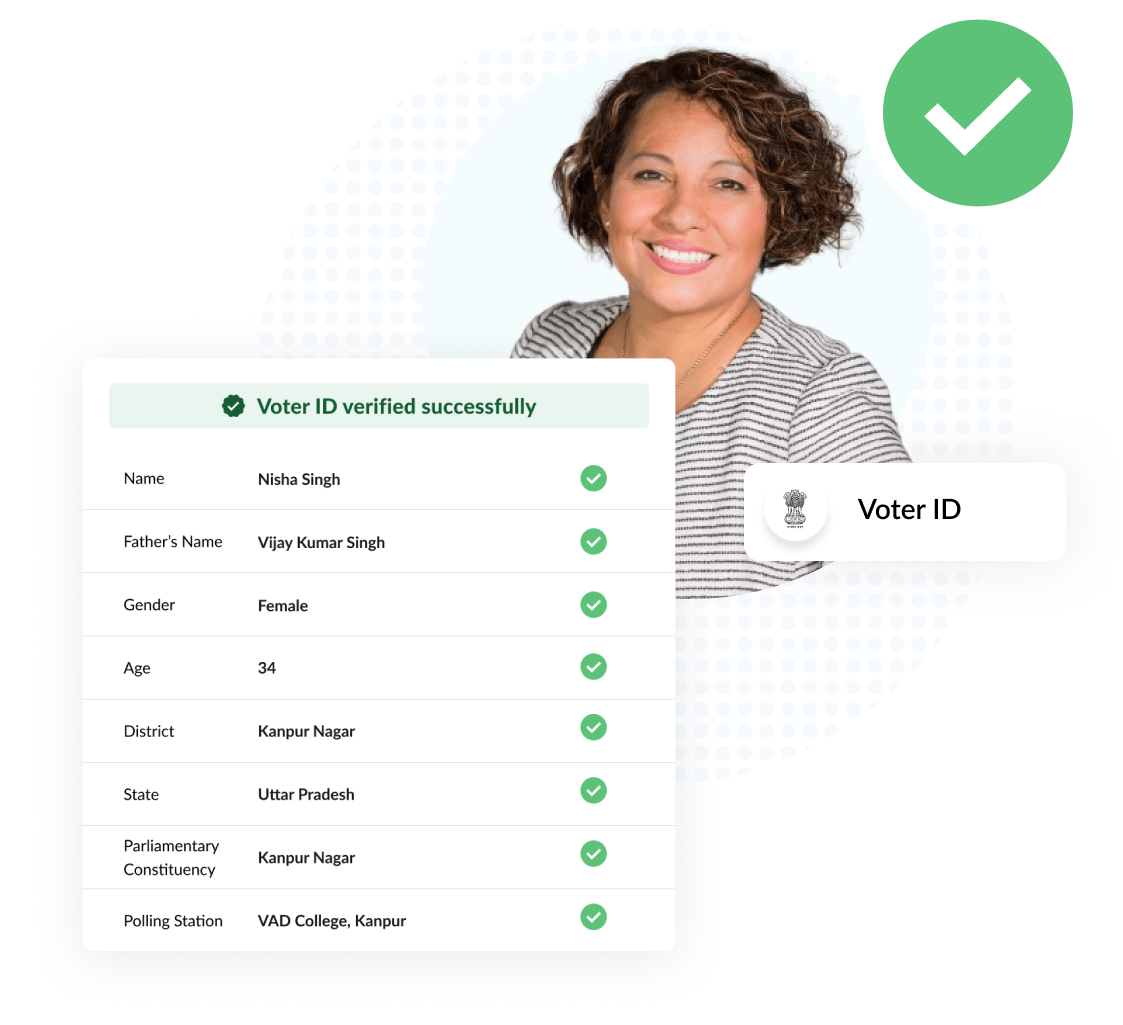

Voter ID

- Check document & information forgery

- Instant verification

- No code platform or Plug and play integration

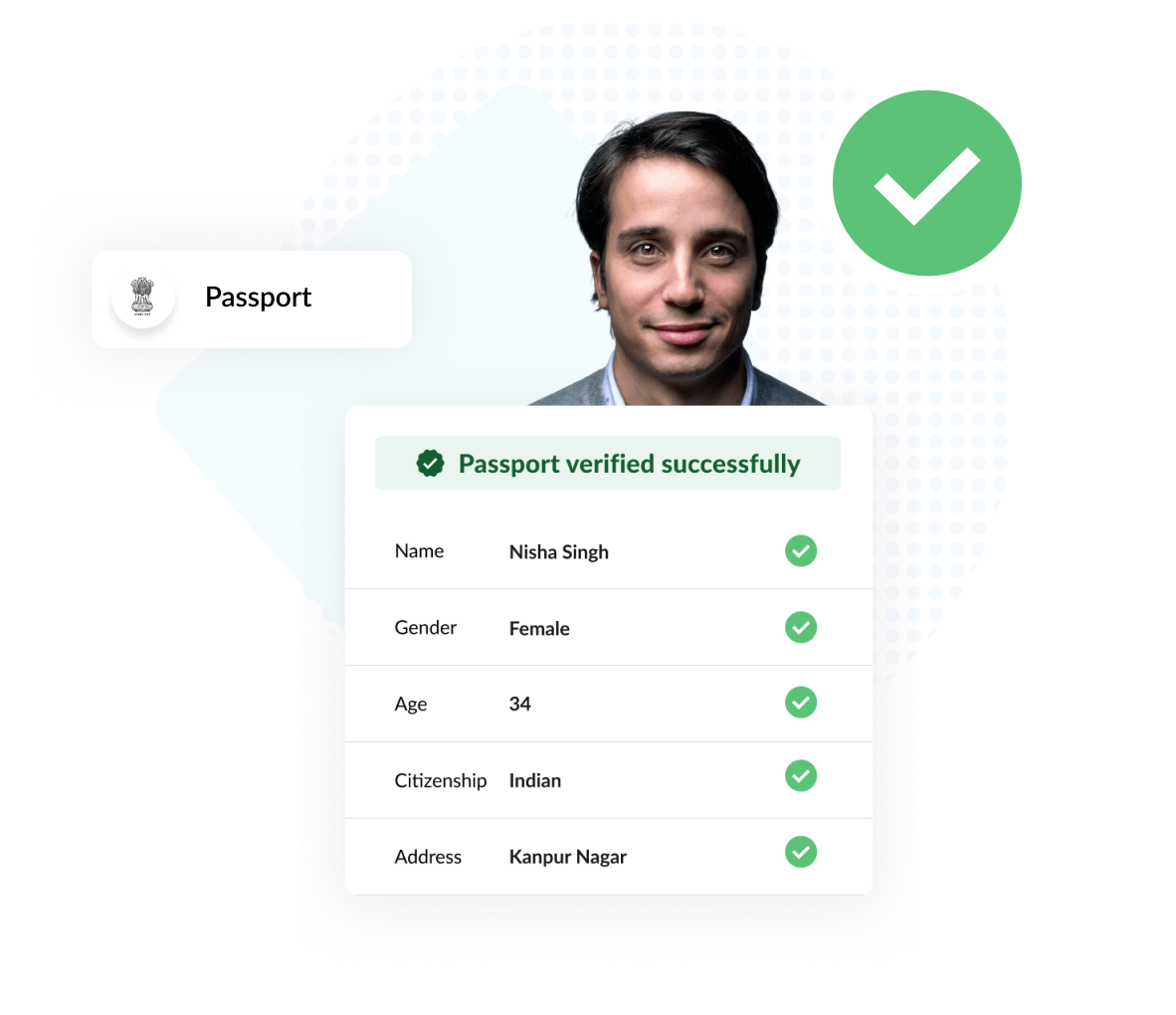

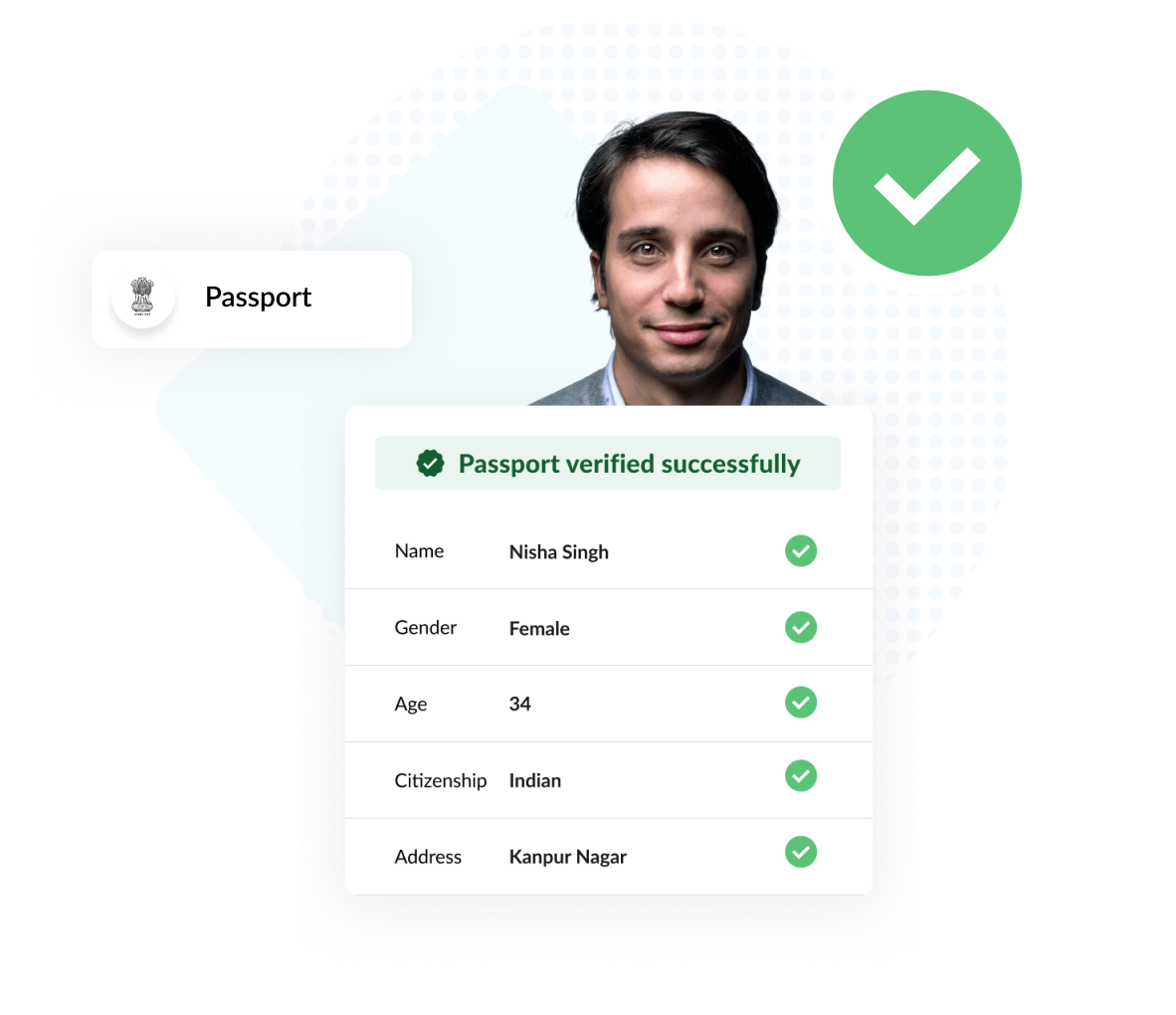

Passport

- Name, Age, Gender

- Citizenship

- Permanent address

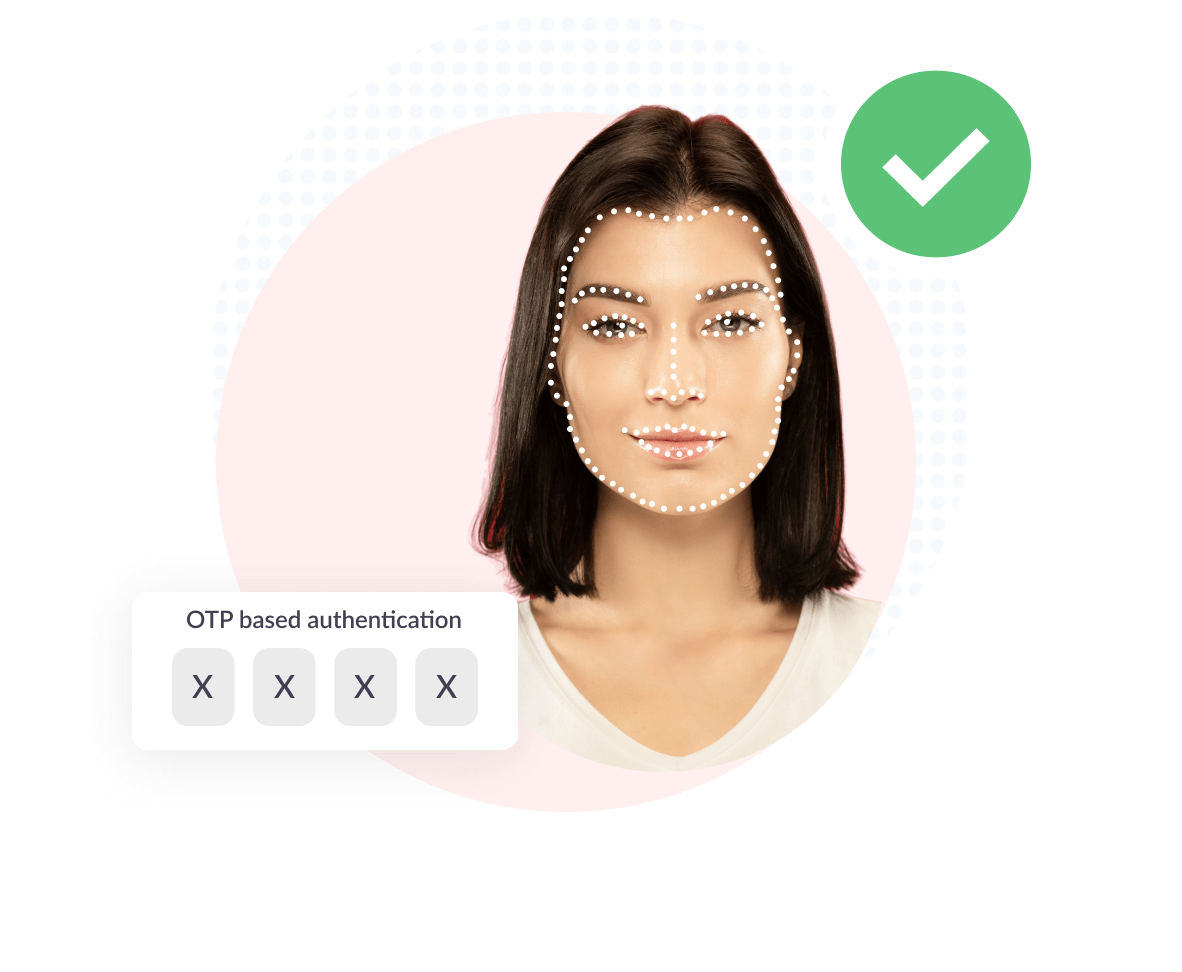

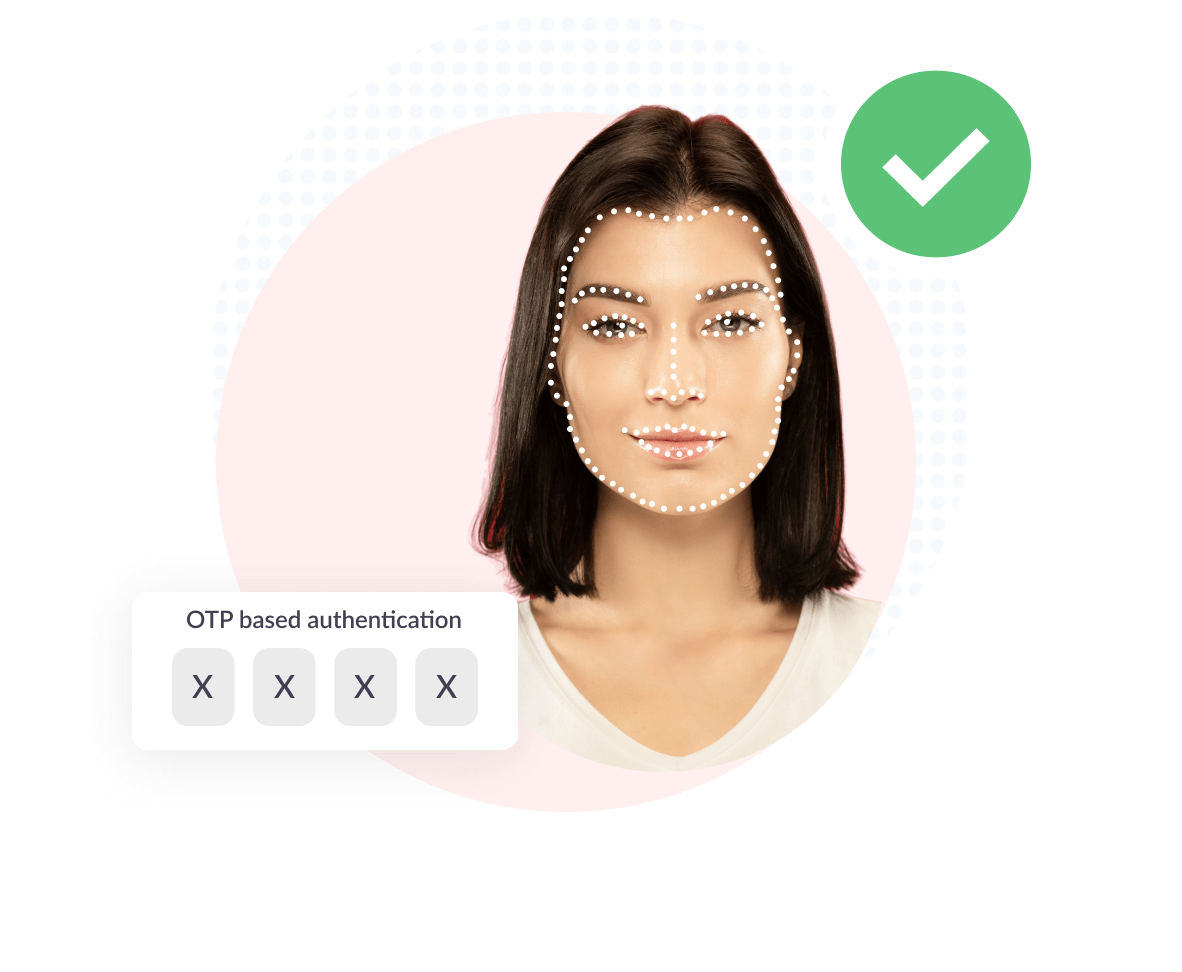

Liveness Check

- Obtain user approval by activating OTP-based Authentication

- Verify address

- Match name as per UIDAI records

- Use an API to automatically populate the relevant fields, enhancing the speed and accuracy of form completion.

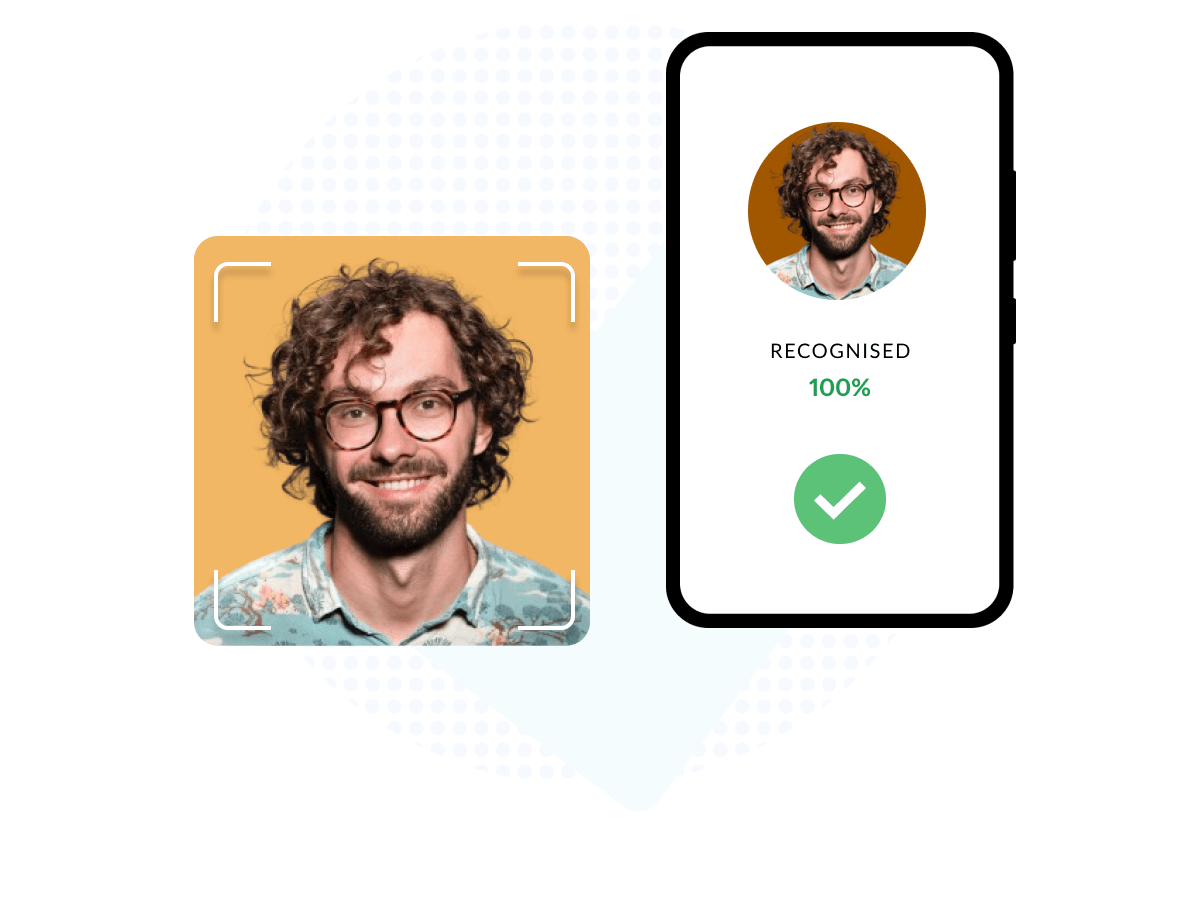

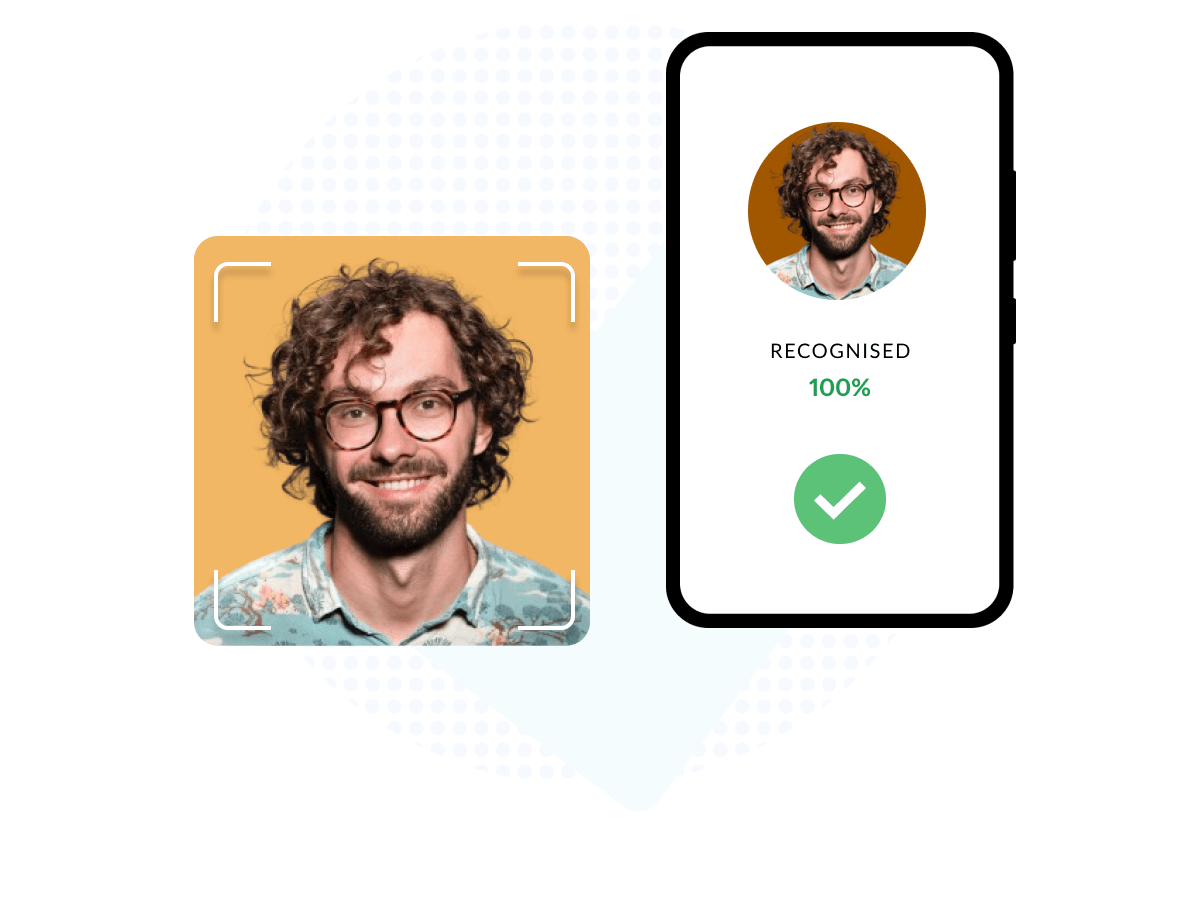

Facematch Check

- Prevent fraud: Check document & information forgery

- Customer onboarding: Instant Face Verification with OVD

- Digital KYC: Plug and play Face Match API

Aadhar Verification

Authenticate user’s Aadhar details. Get information such as the registered name, gender, birthdate, address, state, user’s photograph, father’s name, contact number, and email address in seconds.

- Obtain user approval by activating OTP-based Authentication

- Verify address

- Match name as per UIDAI records

- Use an API to automatically populate the relevant fields, enhancing the speed and accuracy of form completion.

Pan Verification

- Validate the PAN category

- Cross-reference the name with the NSDL database

- Check if Aadhaar is linked with PAN

Driving License

- Name

- Address

- Birthdate

Voter ID

- Check document & information forgery

- Instant verification

- No code platform or Plug and play integration

Passport

- Name, Age, Gender

- Citizenship

- Permanent address

Liveness Check

- Obtain user approval by activating OTP-based Authentication

- Verify address

- Match name as per UIDAI records

- Use an API to automatically populate the relevant fields, enhancing the speed and accuracy of form completion.

Facematch Check

- Prevent fraud: Check document & information forgery

- Customer onboarding: Instant Face Verification with OVD

- Digital KYC: Plug and play Face Match API

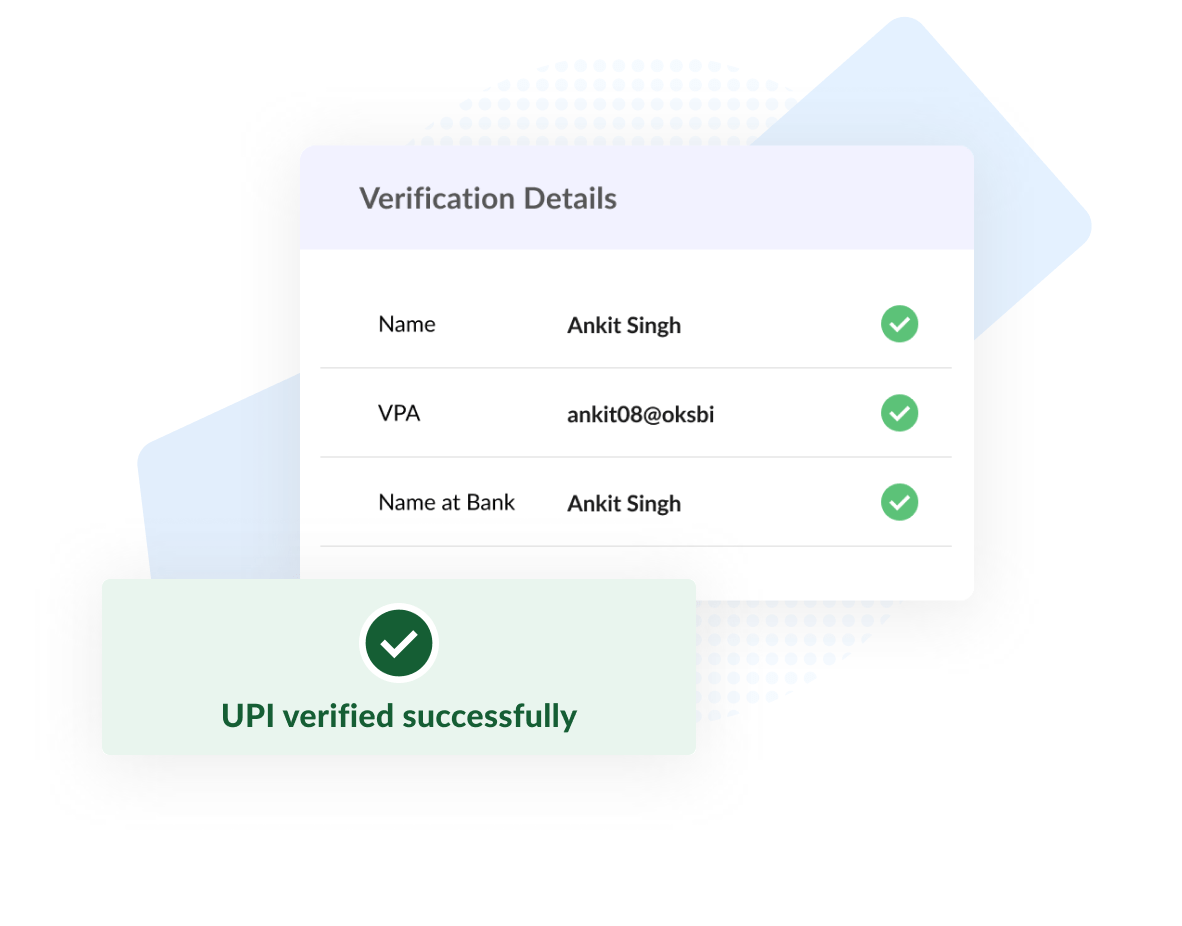

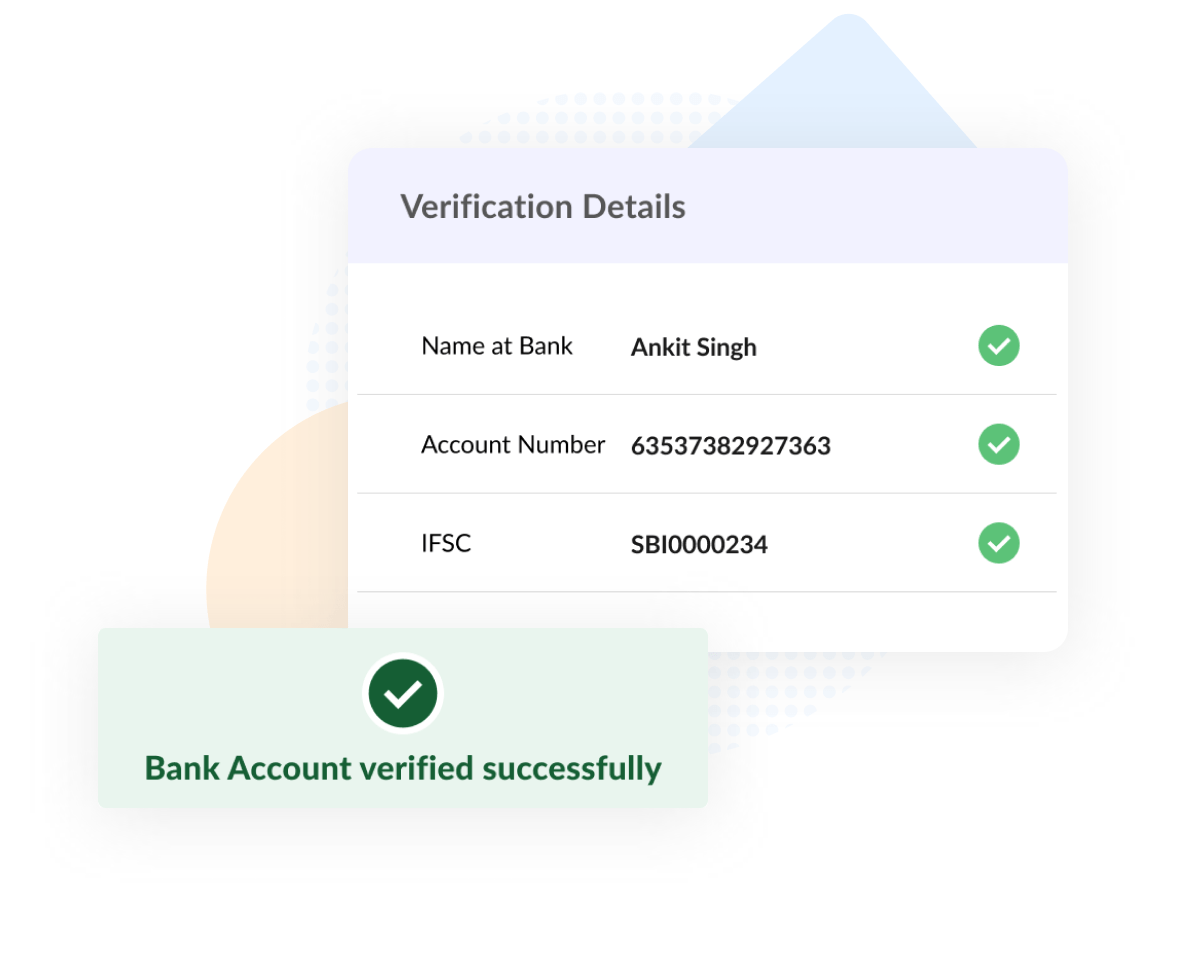

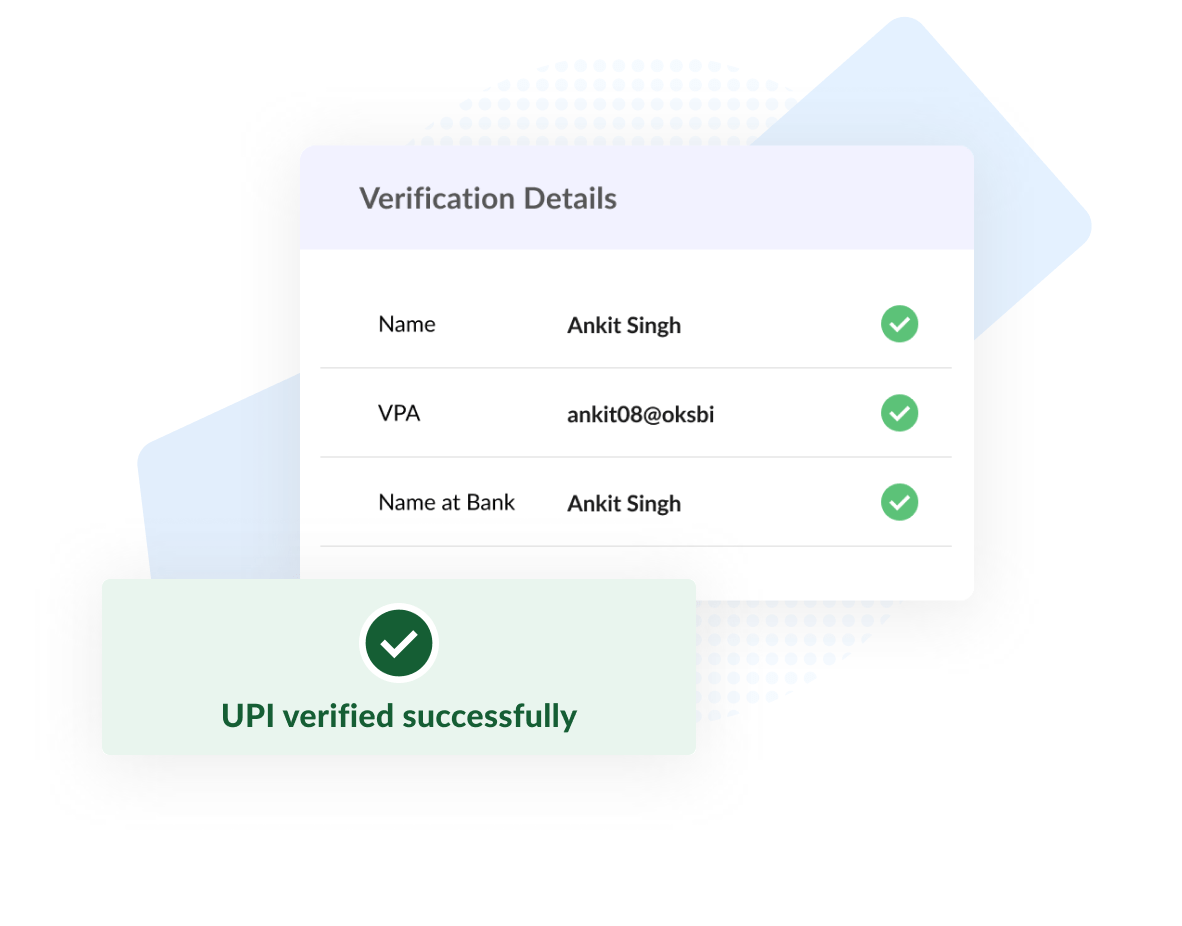

SINGLE & BULK user VERIFICATION

Automated KYC for financial services

- Bank Account Verification

- UPI Verification

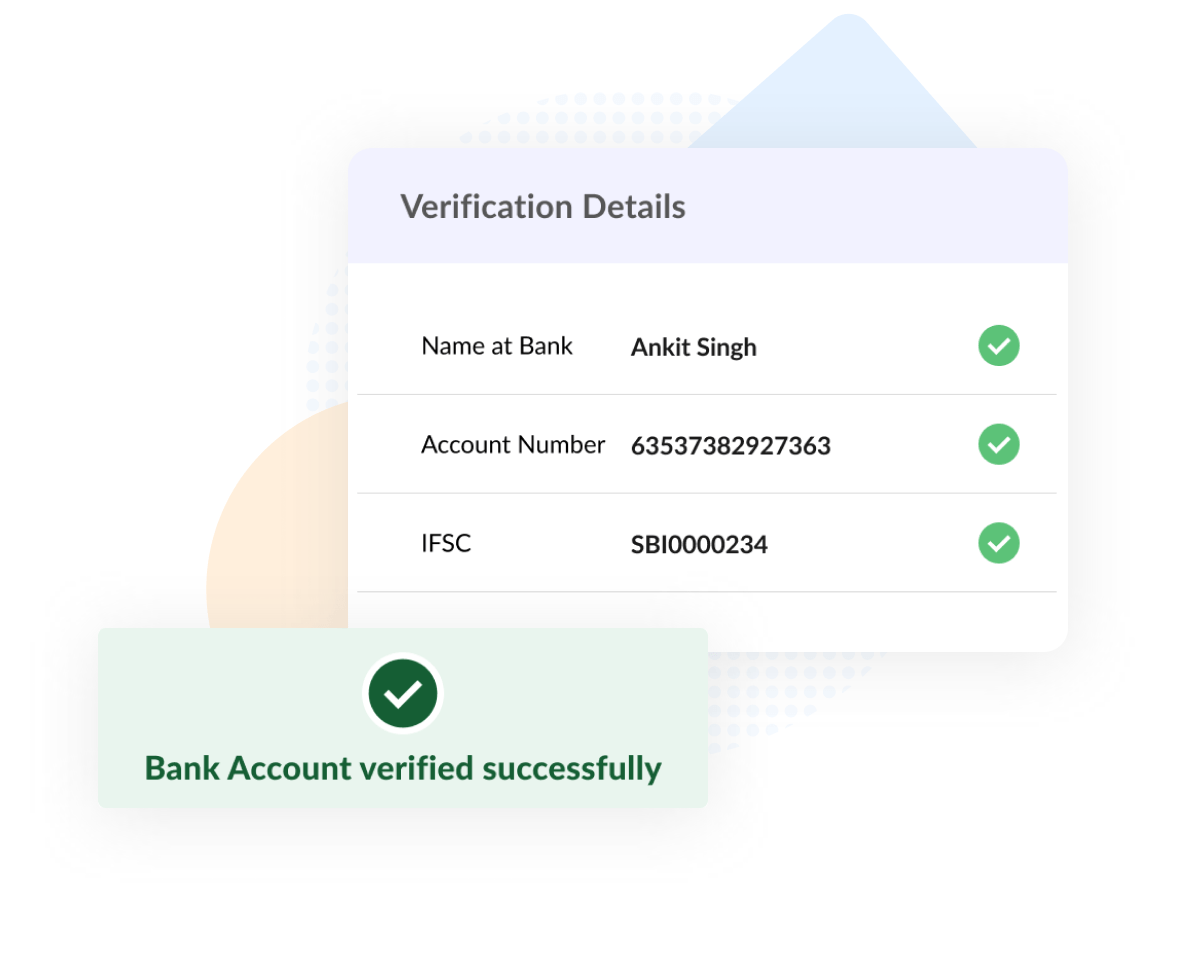

Bank Account Verification

- Validate users before account initiation or as part of the onboarding KYC process.

- Validate users within the refunds redemption workflow.Verify address

- Validate users before initiating payouts or disbursing loans.

UPI Verification

Validate UPI ID or UPI VPA. You can also validate the

customer name against the valid VPA or UPI IDs.

Bank Account Verification

- Validate users before account initiation or as part of the onboarding KYC process.

- Validate users within the refunds redemption workflow.Verify address

- Validate users before initiating payouts or disbursing loans.

UPI Verification

Validate UPI ID or UPI VPA. You can also validate the

customer name against the valid VPA or UPI IDs.

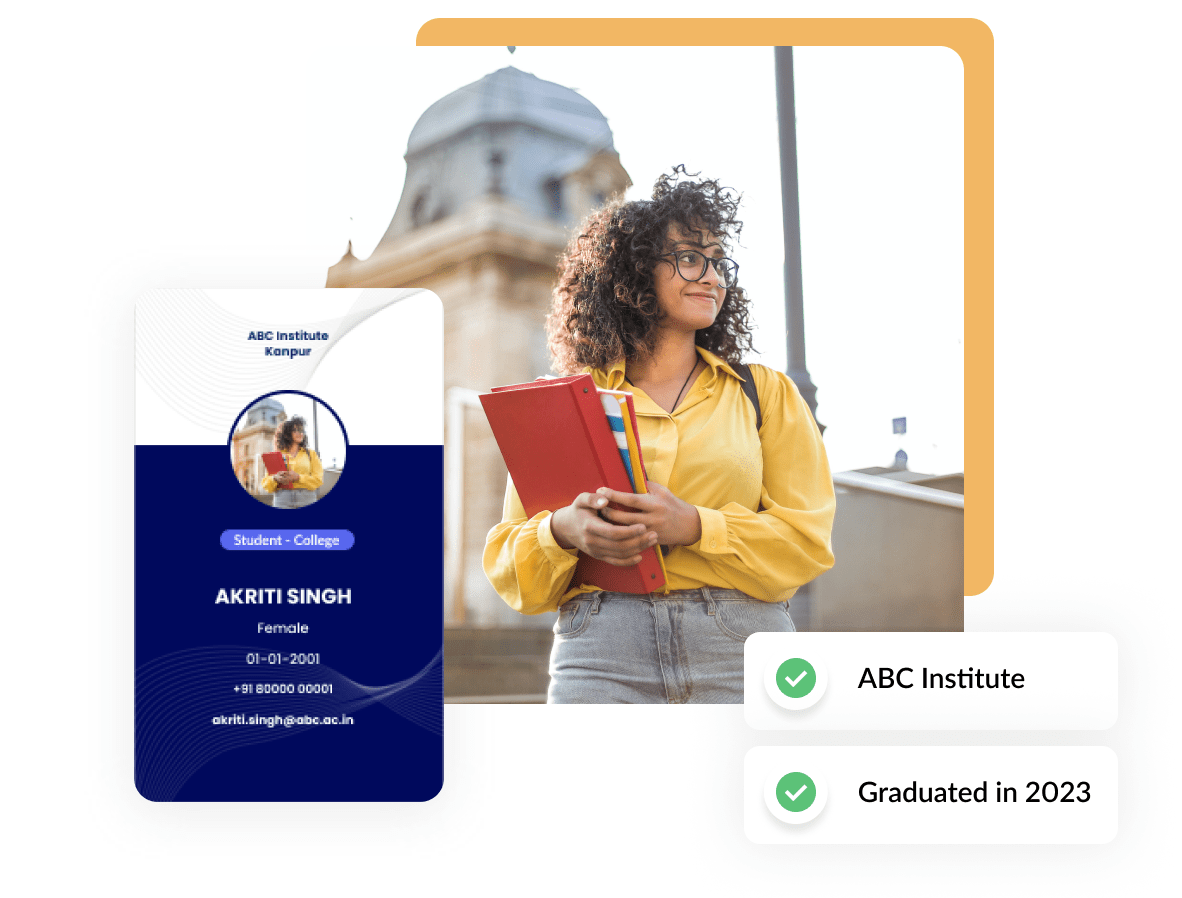

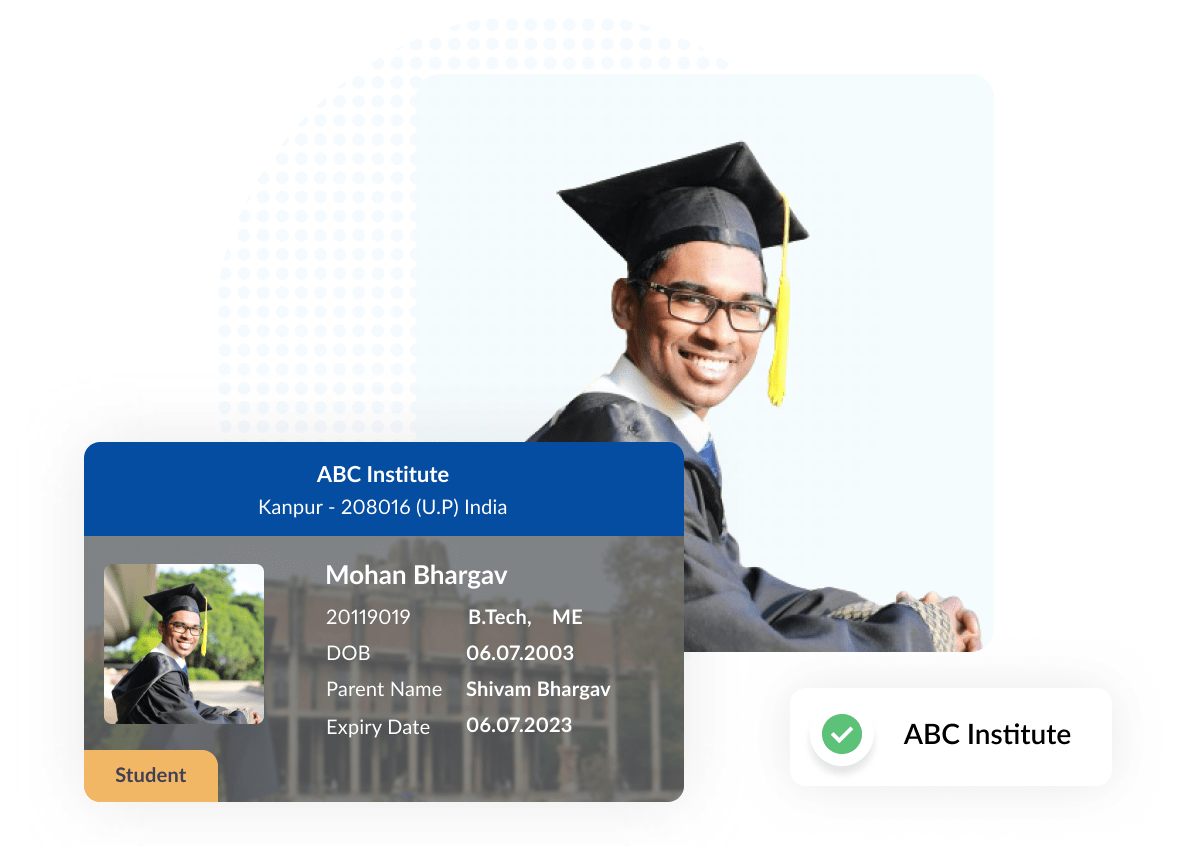

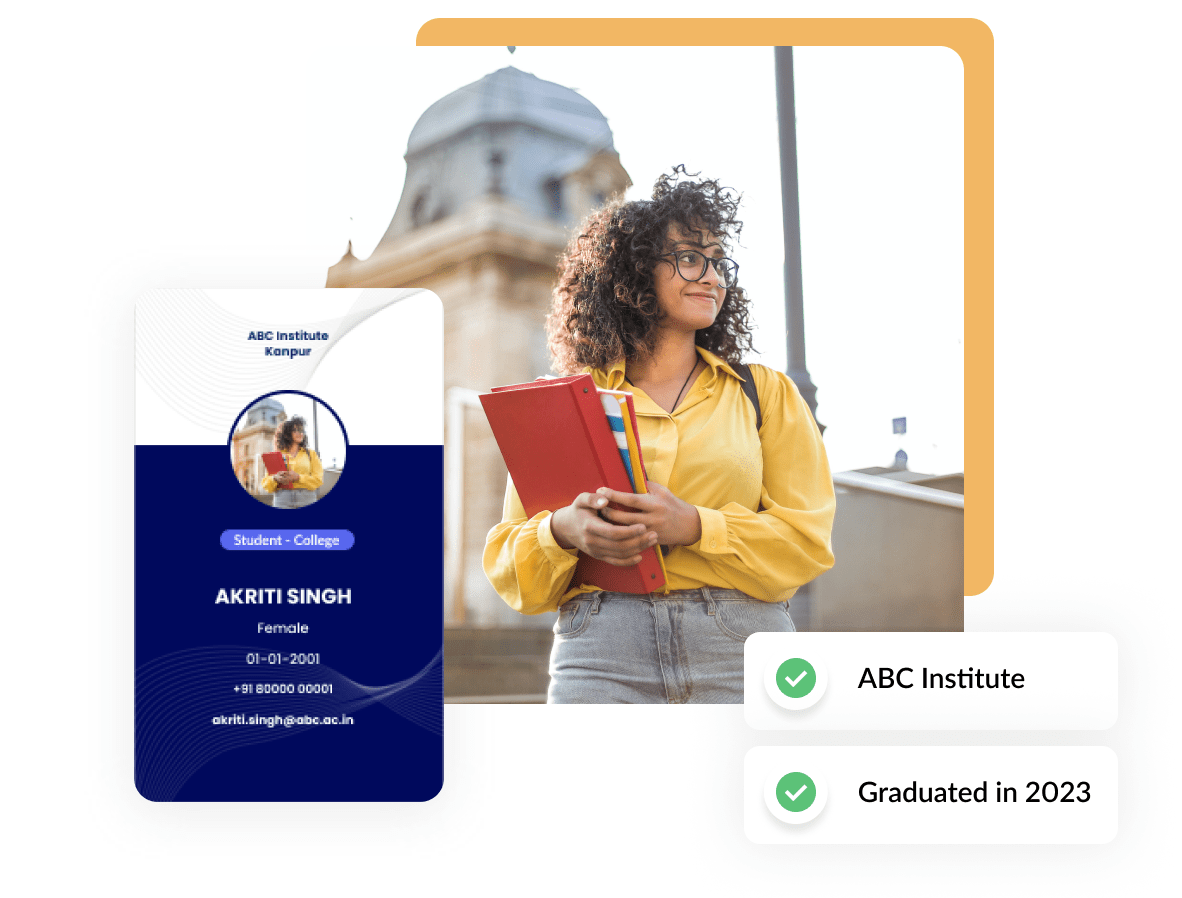

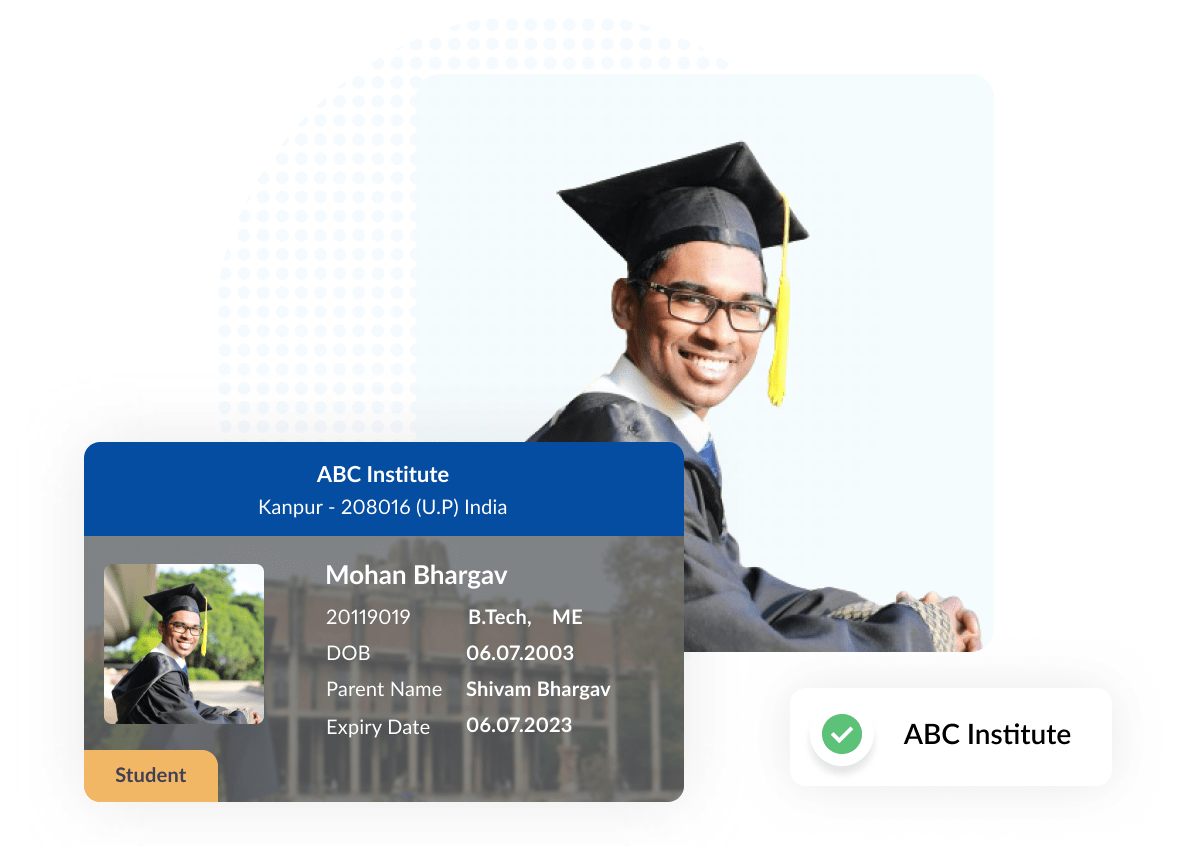

SINGLE & BULK user VERIFICATION

Authenticate educational background

- Student verification

- Institute verification

Student Verification

- College or Institute certificate

- Year of passing

- Identity of the student

Institute Verification

- College or Institute certificate

- Year of passing

- Identity of the student

Student Verification

- College or Institute certificate

- Year of passing

- Identity of the student

Institute Verification

- College or Institute certificate

- Year of passing

- Identity of the student

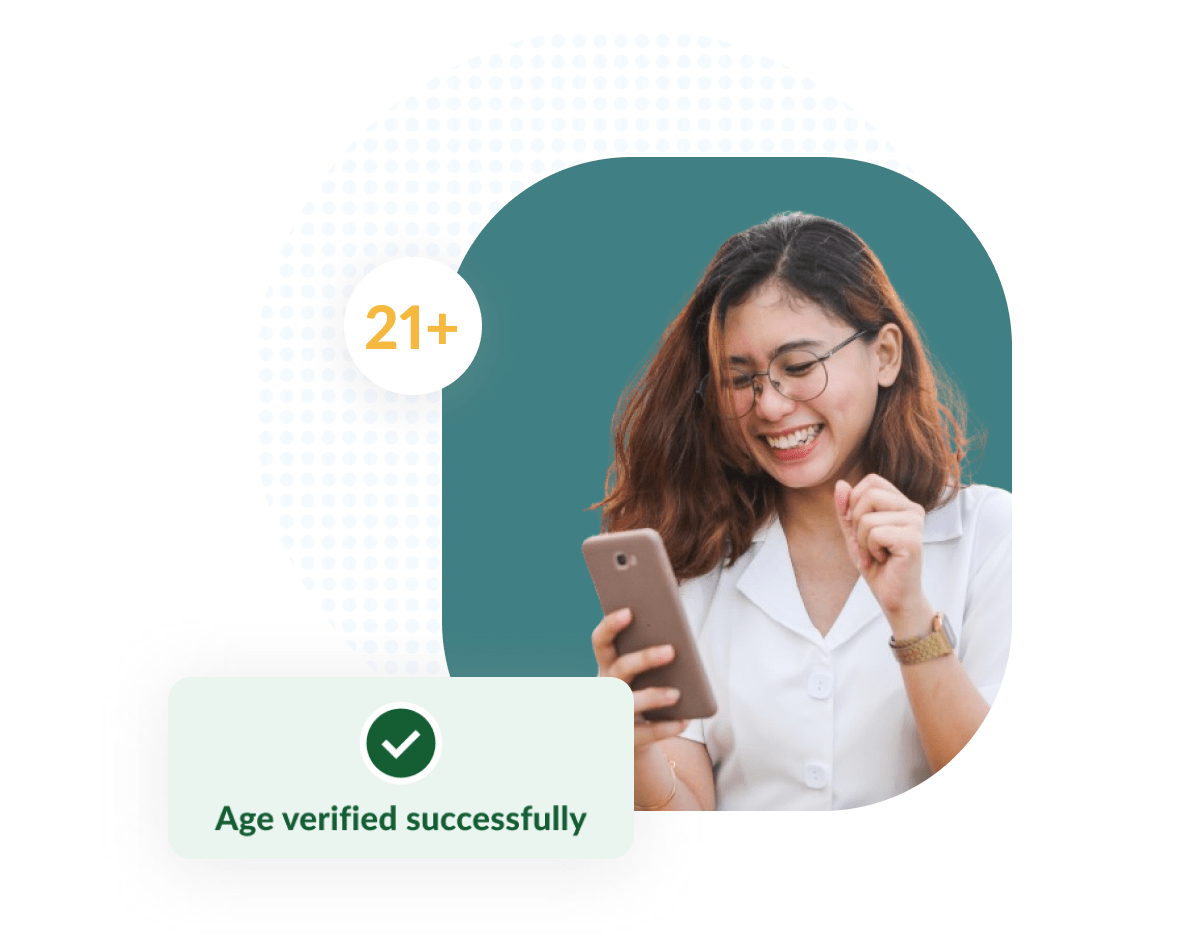

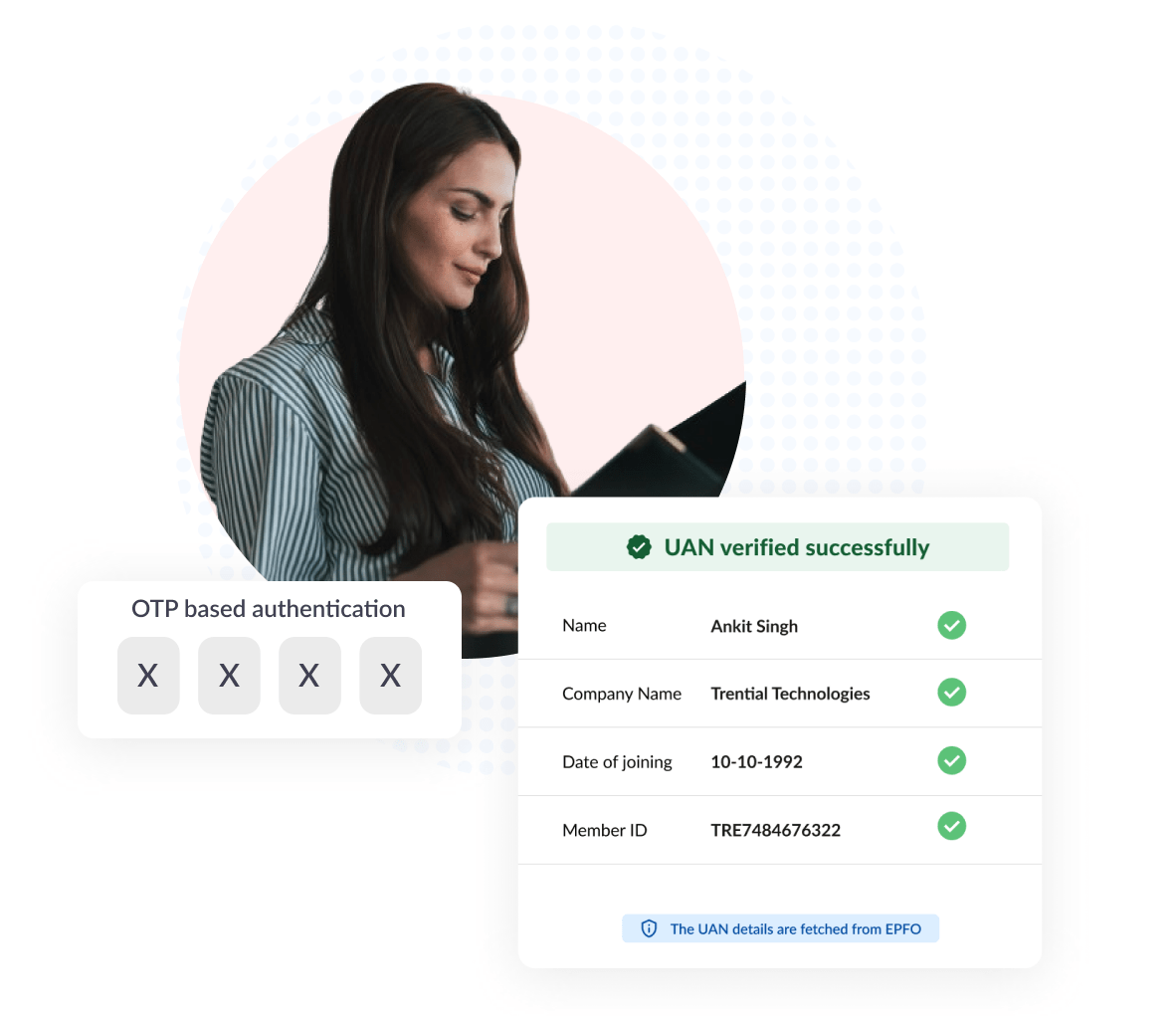

SINGLE & BULK user VERIFICATION

Verify your customer’s age and be compliant

- UAN Check

Aadhar Verification

Authenticate user’s Aadhar details. Get information such as the registered name, gender, birthdate, address, state, user’s photograph, father’s name, contact number, and email address in seconds.

- Obtain user approval by activating OTP-based Authentication

- Verify address

- Match name as per UIDAI records

- Use an API to automatically populate the relevant fields, enhancing the speed and accuracy of form completion.

SINGLE & BULK user VERIFICATION

Avoid moonlighting by employees

- Obtain user approval by activating OTP-based Authentication

- Verify address

- Match name as per UIDAI records

- Use an API to automatically populate the relevant fields, enhancing the speed and accuracy of form completion.

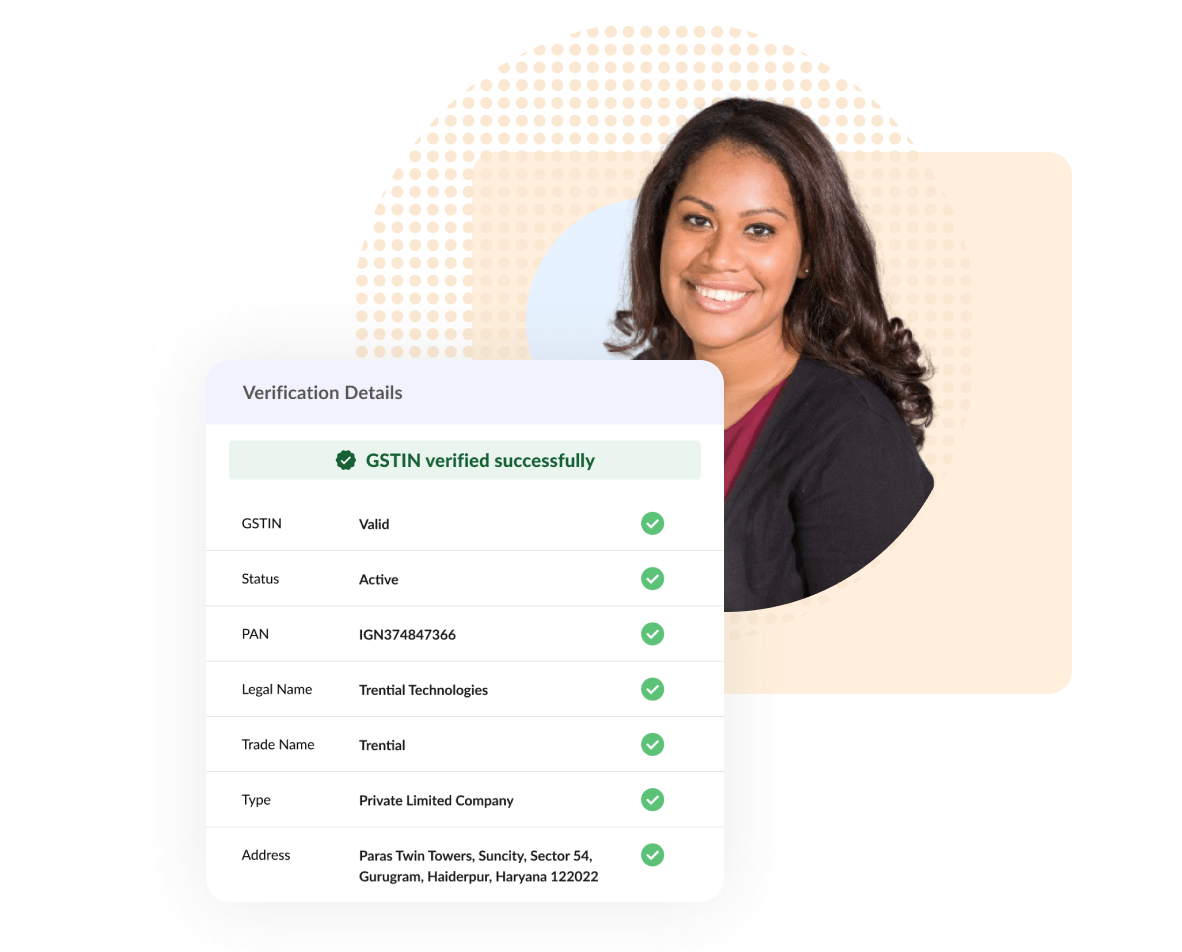

SINGLE & BULK user VERIFICATION

Quick verify company’s GST and CIN records

- Authenticate the registered business address

- Validate the name against GSTIN records

- Guarantee precise ITC claims every time

Redefining Efficiency in

Customer Verification

No Code

No coding required anymore! Anyone can build a verification link and share with customers using our No code platform.

Authorized Digilocker partner

Digilocker Partner

Save integration cost

30% cheaper than other solution providers

Instant verification

Reduce verification time from 3-5 days to just 5 seconds!

Fraud and risk reduction

Always remain compliant with KYC rules, data privacy laws and reduce fraud.

Wallet feature

Reduces repeat KYC costs

Blockchain technology

Unlock the potential of Verity’s verification suite.

Manage your entire verifications in a single platform

Employers and HRs

We assist Employers and HR professionals in making smarter hires through reliable verification solutions. Create an onboarding and background check form in a few seconds and let our engine to the rest for you.

- Seamless Onboarding

- Advanced Verification

- Compliance Assurance

Hospitality

- Seamless Onboarding

- Advanced Verification

- Compliance Assurance

eCommerce businesses

- Vendor check

- Hire verified candidates

- No Code Bulk verifications

Banks

- Seamless Onboarding

- Customisable no-code form

- Compliance Assurance

Partner Apps

Our no-code platform and APIs can be used by firms to verify the identities of heir blue collared workforce during onboarding.

- Seamless Onboarding

- Advanced Verification

- Compliance assurance

College Admins

Colleges can enhance their student verifications by validating their candidate’s identities, educational credentials, and degrees.

- Verify candidates

- Identify false credentials

- Spot information discrepancies

Gaming

Gaming platforms are required by regulatory bodies to verify the Age and Identity of users. Especially, skill based gaming companies can verify their users and follow compliant customer onboarding processes.

- Age check

- Identity Check

- Seamless verification process for users

Healthcare

We assist Healthcare industry with ensuring safety and trust in every hiring professionals through reliable verification solutions. Create an onboarding and background check form in a few seconds.

- Bulk verification

- Customize verification funnel

- Compliant process

APIs for every use case

Trential’s APIs allow you to verify information about individuals, businesses and assets. Sign Up to explore products and and start testing!

Reduce the customer onboarding time with our APIs by 85%. Integrate verification API with your pre-existing ecosystem.

- Verify sensitive user information with highly reliable and secure APIs

- Supports Sync and Async program

- Use the official Trential libraries for different programming languages to integrate with your product and automate the verification flow

- Get notified on single or bulk verification status in real-time via webhooks

Frequently Asked Questions

Have a question? Check our FAQ Sections

The ability to verify bank accounts unlocks valuable opportunities across diverse business scenarios:

1. Employee Background Verification:

Recruitment agencies can utilize this feature to conduct comprehensive candidate background checks, ensuring the accuracy of financial information

2. Vendor Onboarding:

Marketplaces that share commissions with vendors can leverage account verification to confirm bank account details, PAN numbers, and other relevant information during the onboarding process. This not only ensures accurate payments but also streamlines operations and reduces costs through potential integration with existing ERP systems.

3. Financial Services:

- Customer Onboarding: Verify identities and source of funds for new account opening, reducing fraud and complying with KYC/AML regulations.

- Loan Applications: Assess risk and verify income or assets of loan applicants, expediting approval processes and mitigating credit risk.

- Payment Processing: Verify identities and prevent fraudulent transactions, ensuring compliance with payment industry regulations.

4. E-Commerce:

- Customer Account Creation: Verify identities and prevent fraudulent account creation, protecting businesses from chargebacks and fraudulent transactions.

- High-Value Transactions: Verify identities and financial information for high-value purchases, mitigating fraud risk and protecting customer accounts.

- Marketplace Platforms: Verify identities of buyers and sellers, ensuring smooth transactions and building trust within the marketplace.

5. Online Gaming:

- Account Verification: Verify identities and prevent underage gambling, complying with regulatory requirements and protecting children.

- Anti-Money Laundering: Monitor player activity for suspicious transactions, preventing money laundering and ensuring a safe gaming environment.

- Virtual Currency Transactions: Verify identities and source of funds for transactions involving virtual currencies, complying with relevant regulations and mitigating financial crime.

6. Other Industries:

- Real Estate: Verify identities of property buyers and sellers, ensuring compliance with real estate regulations and preventing fraud.

- Professional Services: Verify identities and qualifications of professionals, ensuring clients receive services from qualified individuals.

- Healthcare: Verify identities and insurance information of patients, streamlining healthcare processes and preventing fraud.

7. Beyond Industry-Specific Applications:

- Enhanced Customer Experience: Streamline KYC checks without compromising security, offering a seamless and convenient experience for customers.

- Reduced Operational Costs: Automate manual processes and improve efficiency, leading to significant cost savings.

- Improved Regulatory Compliance: Stay compliant with evolving regulations and avoid hefty fines or penalties.

- Enhanced Brand Reputation: Demonstrate

commitment to security and compliance, fostering trust and loyalty among customers. - These use cases highlight the versatility and adaptability of the KYC Verification Suite, making it a valuable asset for businesses across diverse industries.

Trential fetches the data directly from the updated government databases, hence our data is highly reliable/accurate. To find out

about where each data is fetched from read more here.

On Trential KYC Verification suite, you can instantly verify Bank Account Number, UPI ID, IFSC, PAN, etc. As you submit the request, our API gives an instant response.

No, there is no such limit on number of verifications requests per day. You can use the feature to verify any number of accounts in a day, 24*7.

While onboarding users, vendors, delivery partners, or even employees, an organization needs to do a Bank Account check. Minimize the chance of exposing the data to any third party, integrate Bank Account Verification API with the company’s internal systems and automated the process.

Trential fetches the data directly from the updated government databases, hence our data is highly reliable/accurate. To find out

about where each data is fetched from read more here.

In case the credits get unused, you can reach out to our Support team and raise a request to close the account and transfer the unused credits. Our team will transfer the amount equivalent to the credits in your account and close your account.

Get in Touch With Us

Corporate Headquaters

230 Park Avenue, 3rd Floor

New York, NY 10169

India Office

COWRKS, Tower A Paras Twin Towers, Golf Course Rd, Sector 54, Gurugram, Haryana 122011

KYC Verification Suite

- Identity Verification

- Education Verification

- Bank Details

- Age check

- Company Check

Other Products

Company

Developers

- API Documentation

- Identity Verification

- Education Verification

- Bank Details

- Age check

- Company Check

Corporate Headquarters

230 Park Avenue, 3rd Floor

New York, NY 10169

India Office

COWRKS, Tower A Paras Twin Towers, Golf Course Rd, Sector 54, Gurugram, Haryana 122011